The smart Trick of Palau Chamber Of Commerce That Nobody is Talking About

Table of ContentsWhat Does Palau Chamber Of Commerce Do?The Palau Chamber Of Commerce PDFsGetting The Palau Chamber Of Commerce To WorkSome Known Factual Statements About Palau Chamber Of Commerce Things about Palau Chamber Of CommerceWhat Does Palau Chamber Of Commerce Mean?All About Palau Chamber Of CommerceExcitement About Palau Chamber Of Commerce

As a result, nonprofit crowdfunding is ordering the eyeballs these days. It can be utilized for details programs within the organization or a basic contribution to the cause.During this action, you may want to assume regarding milestones that will certainly indicate a chance to scale your not-for-profit. When you have actually run for a bit, it's important to take some time to think concerning concrete growth objectives.

The Greatest Guide To Palau Chamber Of Commerce

Resources on Beginning a Nonprofit in numerous states in the United States: Beginning a Nonprofit Frequently Asked Questions 1. How much does it cost to begin a not-for-profit company?

More About Palau Chamber Of Commerce

With the 1023-EZ kind, the processing time is usually 2-3 weeks. Can you be an LLC and also a nonprofit? LLC can exist as a not-for-profit restricted responsibility firm, nevertheless, it must be completely possessed by a single tax-exempt nonprofit organization.

What is the difference between a foundation and a nonprofit? Structures are typically funded by a family or a corporate entity, but nonprofits are funded through their revenues and fundraising. Foundations usually take the cash they began out with, invest it, and also after that disperse the cash made from those investments.

What Does Palau Chamber Of Commerce Mean?

Whereas, the additional money a nonprofit makes are utilized as running expenses to money the company's goal. Is it tough to start a not-for-profit organization?

There are numerous steps to begin a not-for-profit, the barriers to entry are reasonably couple of. Do nonprofits pay taxes? If your nonprofit gains any income from unrelated activities, it will certainly owe income tax obligations on that quantity.

The Palau Chamber Of Commerce Ideas

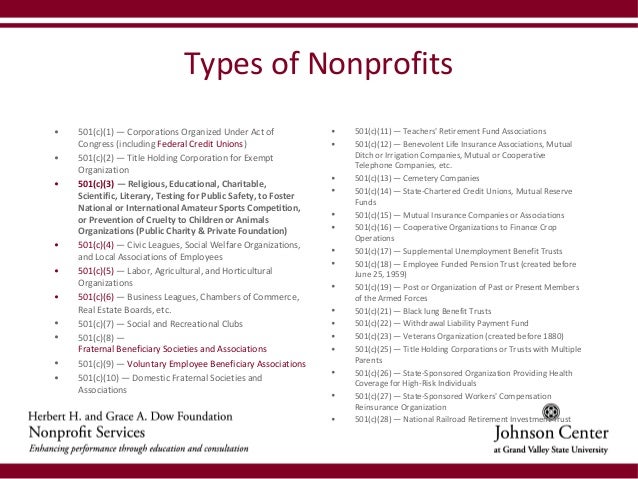

Twenty-eight various sorts of nonprofit organizations are acknowledged by the tax obligation law. Yet by much the most usual sort of nonprofits are Section 501(c)( 3) organizations; (Section 501(c)( 3) is the component of the tax obligation code that accredits such nonprofits). These are nonprofits whose mission is philanthropic, religious, academic, or scientific. Section 501(c)( 3) organization have one substantial advantage over all other nonprofits: contributions made to them are tax deductible by the contributor.

Palau Chamber Of Commerce for Dummies

The bottom line is that exclusive structures obtain much worse tax treatment than public charities. The primary difference in between personal foundations and public charities is where they obtain their financial backing. A personal foundation is usually regulated by a specific, family members, or company, and acquires a lot of its income from a couple of benefactors and also investments-- a fine example is the Bill and also Melinda Gates Structure.

Excitement About Palau Chamber Of Commerce

This is why the tax obligation law is so challenging on them. Many structures just give money to various other nonprofits. Somecalled "operating structures"operate their own programs. As a sensible issue, you require at least $1 million to start an exclusive foundation; otherwise, it's unworthy the problem as well as expenditure. It's not surprising, then, that a personal foundation has been referred to as a huge body of money surrounded by individuals that desire several of it.

Other nonprofits are not so lucky. The IRS at first assumes that they are exclusive structures. Nonetheless, a brand-new 501(c)( 3) organization will be classified as a public charity (not an exclusive structure) when it uses for tax-exempt status if it can reveal that it sensibly can be anticipated to be openly sustained.

4 Easy Facts About Palau Chamber Of Commerce Shown

If the IRS categorizes the nonprofit as a public charity, it keeps this status for its initial five years, regardless of the general public assistance it actually receives throughout this time around. Palau my review here Chamber of Commerce. Beginning with the not-for-profit's sixth tax obligation year, it should reveal that it fulfills the public support examination, which is based on the assistance it Continue gets throughout the existing year and previous 4 years.

If a not-for-profit passes the examination, the IRS will certainly continue to check its public charity condition after the first 5 years by calling for that a completed Set up A be filed each year. Palau Chamber of Commerce. Figure out more concerning your nonprofit's tax obligation condition with Nolo's publication, Every Nonprofit's Tax obligation Overview.